Crude Oil and Refined Products Market Review and Outlook

Crude oil prices surged for the second window in a row as a result of increasing global demand. Demand for petroleum products continues to increase due to global economic growth and high cost of renewable and alternative energy sources. Crude oil price rose by about 4.11% in Q1 to USD85.0780/bbl in Q2 largely attributed to the tensions in the Middle East and the Russia-Ukraine war. Global economic growth continues to propel crude and petroleum products prices.

According to the International Energy Agency (IEA), oil prices increased in June despite mounting concerns over the health of the Chinese economy and slowing oil demand growth. This increase has been largely driven by strong demand from fast-growing economies in Asia, as well as from the aviation and petrochemicals sectors.

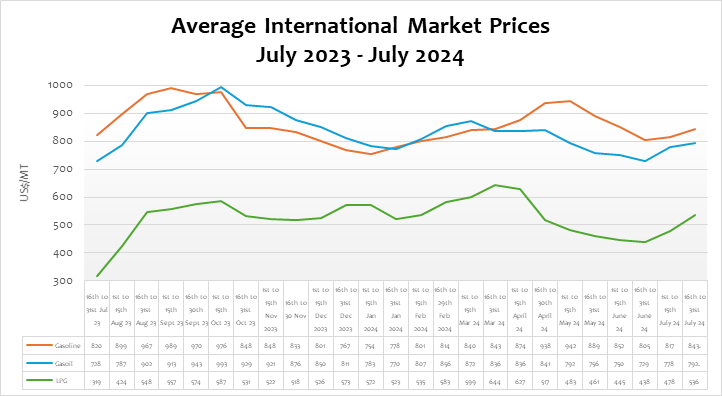

Global prices of petrol, diesel, and LPG increased by 3.23%, 1.80%, and 12.21%, respectively, in the window under review. This represents a year-on-year inrease of 2.77%, 8.82%, and 68.01% for petrol, diesel, and LPG respectively.

Although crude and petroleum product demand is expected to decline due to the increasing adoption of EVs and other renewable energy equipment, the IEA has projected global crude oil production to outstrip demand between now and 2030.

FuFeX30 and Spot Rates

The Fufex30[1] for the second selling window of July (16th to 31st July 2024) is estimated at GHS15.7000/USD, while the applicable spot rate for cash sales is GHS15.5500/USD based on quotations received from oil financing commercial banks.

| SUMMARY REPORT OF BANK OF GHANA FX AUCTIONS TO BIDECs | ||

| Window | Percentage Offered | Auction FX Rate (GHS/USD) |

| 1st to 15th March 2024 | 23% | 12.7291 |

| 16th to 31st March 2024 | 22% | 12.9737 |

| 1st to 15th April 2024 | 30% | 13.1160 |

| 16th to 30th April 2024 | 31% | 13.2259 |

| 1st to 15th May 2024 | 29% | 13.8643 |

| 16th to 31st May 2024 | 30% | 14.1419 |

| 1st to 15th June 2024 | 23% | 14.8388 |

| 16th to 30th June 2024 | 29% | 15.0523 |

| 1st to 15th July 2024 | 21% | 15.3169 |

| 16th to 31st July 2024 | 28% | 15.4526 |

The BoG’s bi-weekly FX auction to BIDECs in the 16th to 31st July 2024 pricing window for the purchase of petroleum products was US$20 million, representing 28% of BIDECs’ bid. The FX rate at which the BoG auctioned to BIDECs rose from GHS10.5151 in January to GHS15.4526 per USD in July, representing a depreciation of 46.97% year-to-date. The sharp depreciation of the cedi is currently robbing consumers of the benefits of the global decline in crude and petroleum product prices.

The Ex-Refinery Price Indicator (Xpi)

The Ex-ref price indicator (Xpi) is computed using the referenced international market prices usually adopted by BIDECs, factoring in the CBOD economic breakeven benchmark premium for a given window, and converting from USD/mt to GHS/ltr using the Fufex30 for sales on credit and the spot FX rate for sales on cash.

Ex-ref Price Effective 16th to 31st July 2024

| Price Component | Petrol | Diesel | LPG |

| Average World Market Price (US$/mt) | 843.0000 | 792.3200 | 536.1100 |

| CBOD Benchmark Breakeven Premium (US$/mt) | 95 | 100 | 240 |

| Spot FX Rates | 15.5500 | 15.5500 | 15.5500 |

| FuFex30 (GHS/USD) | 15.7000 | 15.7000 | 15.7000 |

| Volume Conversion Factor (ltr/mt) | 1324.50 | 1183.43 | 1000.00 |

| Ex-ref Price (GHS/ltr) Cash Sales | 11.0124/ltr | 11.7249/ltr | 12.0685/kg |

| Ex-ref Price (GHS/ltr) 45-day Credit Sales | 11.1186/ltr | 11.8380/ltr | 12.1849/kg |

| Price Tolerance | +1%/-1% | +1%/-1% | +1%/-1% |

Taxes, Levies, and Regulatory Margins

Total taxes, levies and regulatory margins within the 1st to 15th July 2024 selling window accounted for 22.52%, 22.26%, and 13.48% of the ex-pump prices of petrol, diesel and LPG, respectively.

| TRM Components | Petrol (GHS/ltr) | Diesel (GHS/ltr) | LPG (GHS/KG) |

| ENERGY DEBT RECOVERY LEVY | 0.49 | 0.49 | 0.41 |

| ROAD FUND LEVY | 0.48 | 0.48 | – |

| ENERGY FUND LEVY | 0.01 | 0.01 | – |

| PRICE STABILISATION & RECOVERY LEVY | 0.16 | 0.14 | 0.14 |

| SANITATION & POLLUTION LEVY | 0.10 | 0.10 | – |

| ENERGY SECTOR RECOVERY LEVY | 0.20 | 0.20 | 0.18 |

| PRIMARY DISTRIBUTION MARGIN | 0.26 | 0.26 | – |

| BOST MARGIN | 0.12 | 0.12 | – |

| FUEL MARKING MARGIN | 0.09 | 0.09 | – |

| SPECIAL PETROLEUM TAX | 0.46 | 0.46 | 0.48 |

| UPPF | 0.90 | 0.90 | 0.85 |

| DISTRIBUTION/PROMOTION MARGIN | – | – | 0.05 |

| TOTAL | 3.27 | 3.25 | 2.11 |

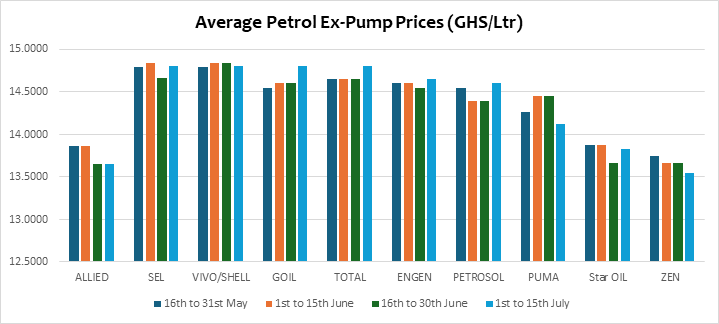

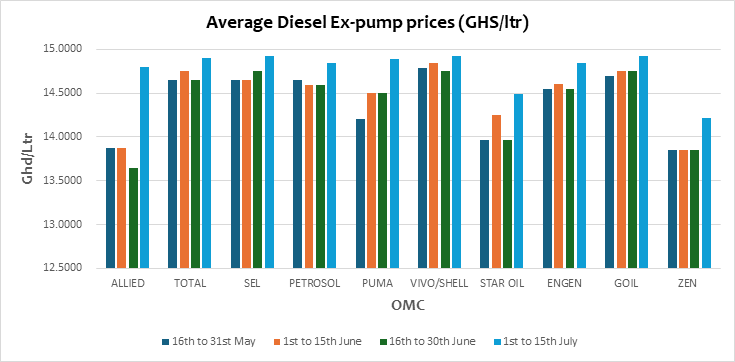

OMC Pricing Performance: 1st to 15th July 2024

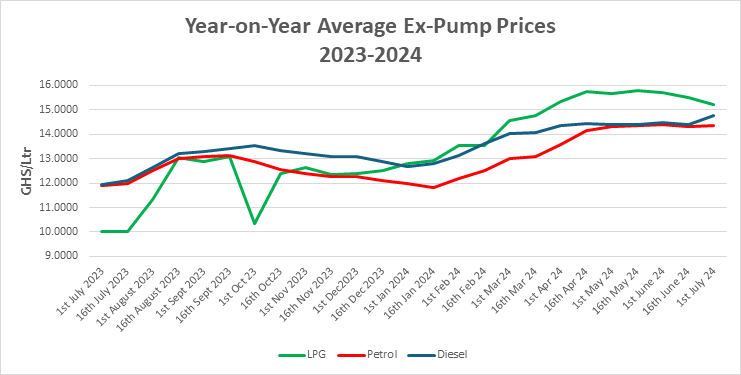

Pump prices of petrol, diesel, and LPG have continued to increase since the beginning of the year, primarily due to the depreciation of the cedi.

Crude and petroleum product prices on the international market rose in the last pricing window of June and the first pricing window of July. This increase, coupled with the depreciation of the cedi from about GHS12.0000 per USD in January to about GHS15.0000 per USD largely accounts for the hikes pump prices.

The Ghanaian cedi has depreciated by an average of over GHS4.5000 against the USD since January 2024, pushing pump prices to their highest in over 15 months. This trend illustrates the impact of FX on the prices of petroleum products at the pumps and the correlation between FX and pump prices.

As a result of depreciation, pump prices of petrol have increased by over 50% since March 2022 and by over GHS2.50/Ltr on average since January 2024. Petrol pump prices, which averaged GHS9.3390/Ltr in 2022, are currently being quoted at about GHS14.8000/Ltr by some OMCs. This increase is largely attributed to the sharp depreciation of the cedi. Petrol prices at the pumps are expected to further increase in the 16th to 31st July pricing window due to the combined effect of a hike in the international price of petrol and the depreciation of the cedi.

Pump prices of diesel also rose by about 2.6% from GHS14.4010 to GHS14.7760 due to the depreciation of the cedi within the selling window. Due to the increase in global prices and the depreciation of the cedi, diesel prices are expected to increase in the 16th to 31st July pricing window.

The government and the Central Bank may need to adopt measures that will stabilize the cedi and allocate sufficient FX for oil importation to curtail the impact of the volatile FX situation on pump prices.

[1] The Fufex30 is a 30-day GHS/USD forward fx rate used as a benchmark rate for BIDECs ex-ref price estimations.

The post Market Outlook – 15th to 31st July 2024 Pricing Window appeared first on CBOD Ghana.