Refined Products Review and Outlook

Global prices of crude oil have continued to follow a downward trajectory since the beginning of Q4 2023. Crude oil prices declined significantly in the first week of December to levels recorded in July, when high global inflation resulted in a significant decline in global demand for crude. Demand for crude and petroleum products surged in Q3 mainly due to the decline in global inflation and the positive signs of economic recovery from China and the US, which resulted in a surge in economic activity. Moreover, crude and petroleum prices surged in Q3 owing to the decline in production by major OPEC+ nations such as Saudi Arabia and Russia by about 1.6 million barrels per day. However, gloomy economic outlook, as indicated by weak economic data from China and the US, has resulted in a significant fall in crude oil prices in Q4. Crude prices have fallen by about 17.2% from about USD94.76/bbl in September to about USD78.47/bbl in the First window of December.

According to CITAC Africa, interest rates are expected to stay higher for longer, while other economic indicators in the US, Europe, and China all suggest weaker economic growth, thus, weakening the outlook for oil demand growth. Additionally, the IEA has decreased its forecast of average Brent prices in 2024 from USD96/bbl to USD95/bbl due to the possible escalation of the conflict in the Middle East and the worsening global economic environment.

However, global production continues to increase, according to reports from the IEA. The IEA Market Report for November indicates that global supply increased by 320 kb/d in October. The surge in production is largely driven by production from non-OPEC+ nations such as the US and Brazil. The IEA has further projected that global supply will increase in 2024 by about 1.6mn b/d, mainly from non-OPEC+ nations.

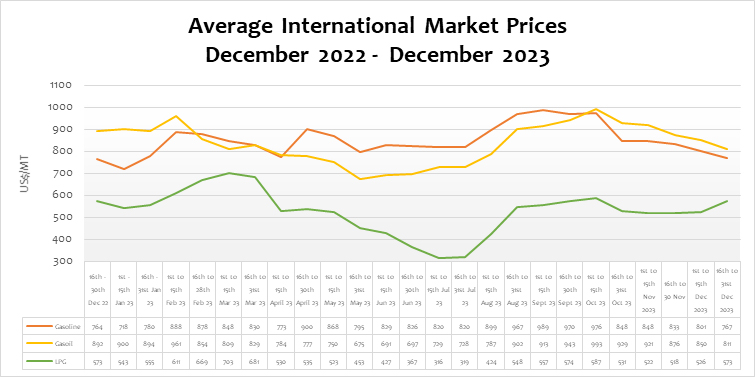

The international market price of petrol and diesel declined by 4.2% and 4.6%, respectively, while LPG rose by 8.9% in the second selling window of December. Compared to the same period last year, diesel and LPG prices declined by 9.2% and 0.1%, respectively, while petrol rose by 0.5%. On a year-to-date basis, while the international market price of petrol and LPG rose by 6.9% and 5.5%, respectively, diesel declined by 10.0%.

FuFeX30 And Spot Rates

The Fufex30[1] for the first selling window of December (16th to 31st December 2023) is estimated at GHS12.4000/USD, while the applicable spot rate for cash sales is GHS12.2500/USD based on quotations received from oil financing commercial banks.

[1] The Fufex30 is a 30-day Ghs/USD forward fx rate used as a benchmark rate for BIDECs ex-ref price estimations.

| SUMMARY REPORT OF BANK OF GHANA FX AUCTIONS TO BIDECs | ||

| Window | Percentage Offered | Auction FX Rate (GHS/USD) |

| 16th – 31st May 2023 | 26% | 11.6943 |

| 1st – 15th June 2023 | 39% | 11.1657 |

| 16th – 30th June 2023 | 33% | 11.1781 |

| 1st – 15th July 2023 | 25% | 11.3737 |

| 16th – 31st July 2023 | 30% | 11.3737 |

| 1st – 15th August 2023 | 27% | 11.3312 |

| 16th – 31st August 2023 | 30% | 11.3460 |

| 16th – 30th September 2023 | 22% | 11.4232 |

| 16th – 31st October 2023 | 20% | 11.6435 |

| 1st – 15th November 2023 | 21% | 11.6824 |

| 16th – 30th November 2023 | 21% | 11.9131 |

| 1st to 15th December 2023 | 19% | 11.9131 |

[1] The Fufex30 is a 30-day Ghs/USD forward fx rate used as a benchmark rate for BIDECs ex-ref price estimations.

The BoG’s bi-weekly FX auction to BIDECs in the 1st to 15th December 2023 pricing window for the purchase of petroleum products was US$20 million, representing 19% of BIDECs’ bid. The FX rate auctioned by BoG to BIDECs was GHS11.9131/USD, the same rate as the previous window.

Ex-ref Price Effective 16th to 31st December 2023

As a result of the slight depreciation of the cedi against the USD and marginal decline in the international prices, the indicative Ex-refinery prices of petrol, diesel and LPG are shown in the table below.

| Price Component | Petrol | Diesel | LPG |

| Average World Market Price (US$/mt) | 767.2000 | 810.7000 | 573.2000 |

| Ex-ref Price (GHS/ltr) Cash Sales | 8.2055/ltr | 9.6339/ltr | 9.2267/kg |

| Ex-ref Price (GHS/ltr) 45-day Credit Sales | 8.3060/ltr | 9.7519/ltr | 9.3397/kg |

| Price Tolerance | +1%/-1% | +1%/-1% | +1%/-1% |

Taxes, Levies, and Regulatory Margins

Total taxes, levies, and regulatory margins within the 1st to 15th December selling window accounted for 24%, 22%, and 15% of the ex-pump prices of petrol, diesel, and LPG, respectively.

| TRM Components | Gasoline (GHS/ltr) | Gasoil (GHS/ltr) | LPG (GHS/KG) |

| ENERGY DEBT RECOVERY LEVY | 0.49 | 0.49 | 0.41 |

| ROAD FUND LEVY | 0.48 | 0.48 | – |

| ENERGY FUND LEVY | 0.01 | 0.01 | – |

| PRICE STABILISATION & RECOVERY LEVY | 0.16 | 0.14 | 0.14 |

| SANITATION & POLLUTION LEVY | 0.10 | 0.10 | – |

| ENERGY SECTOR RECOVERY LEVY | 0.20 | 0.20 | 0.18 |

| PRIMARY DISTRIBUTION MARGIN | 0.13 | 0.13 | – |

| BOST MARGIN | 0.09 | 0.09 | – |

| FUEL MARKING MARGIN | 0.5 | 0.09 | – |

| SPECIAL PETROLEUM TAX | 0.46 | 0.46 | 0.48 |

| UPPF | 0.75 | 0.75 | 0.75 |

| DISTRIBUTION/PROMOTION MARGIN | – | – | 0.05 |

| TOTAL | 2.96 | 2.94 | 2.01 |

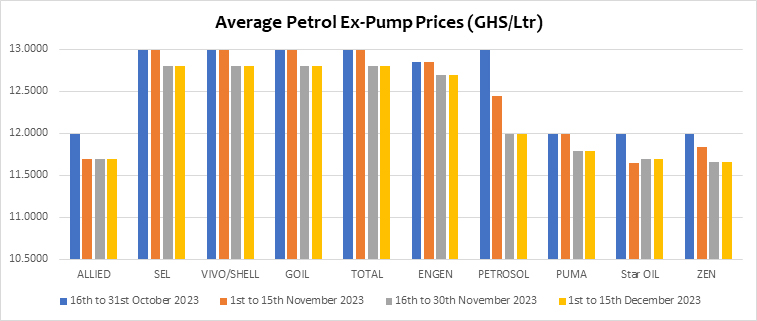

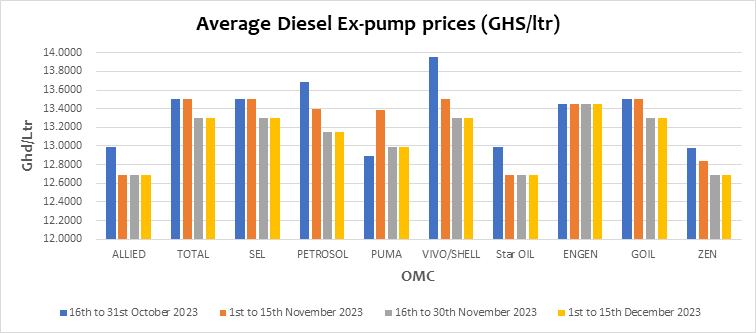

OMC Pricing Performance: 1st to 15th December 2023

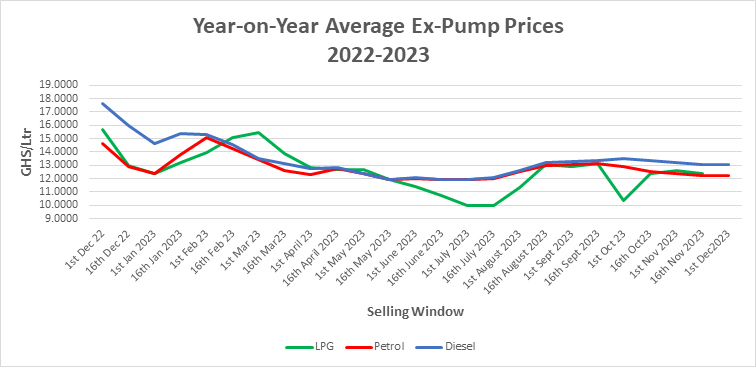

The average prices of petroleum products for the first window of December saw no changes at the pumps. Despite a decrease in international crude and petroleum product prices from the 12th to the 27th of November 2023, pump prices remained steady. This was largely attributed to the depreciation of the Cedi against the US Dollar during the period. The demand for crude and petroleum products continues to slump due to high global inflation and interest rates suppressing global demand.

Crude prices declined from about USD94.76/bbl at the end of September 2023 to about USD81.84/bbl in November and further declined to about USD78.47/bbl in the first week of December 2023. Notwithstanding, the IEA has projected demand to surge due to the significant cut in crude production by OPEC+, the fall in crude inventories, and the mild post-COVID economic recovery in China. Thus, increasing global prices to an average of USD95/bbl in 2024.

As reported by Reuters, China’s economic activity outturn perked up in October due to an increase in industrial output and retail sales. This development serves as an optimistic indicator for the world’s second-largest economy.

The performance of the Cedi/USD exchange rate also depreciated relatively in the selling window under review by about 3 percent. Therefore, fuel prices are expected to remain stable going into the end of the year due to the depreciation of the Cedi in Q4 owing to an increase in corporate demand for foreign exchange and the ongoing decline in global crude prices.

Although the Cedi depreciated, pump prices of petrol within the period remained unchanged at GHS 12.2244/Ltr. This was mainly due to the decline in global prices by about 5%. On a y-o-y basis, petrol pump prices declined by about 16.0% and 0.7% y-t-d basis. This declining trend is expected to reverse going into January 2024 as Saudi Arabia and Russia resolve to maintain their decision to cut production through to the end of the year.

Similar to the pump price of petrol, diesel prices remained unchanged at an average of GHS13.0860/ltr in the 1st to 15th December window. On a year-on-year basis, pump prices for diesel declined by about 25.8% and 10.4% year-to-date. From the second selling window of June to the current pricing window, diesel pump prices have risen by about 11%. This rise is attributed to international market factors, as the Cedi/USD exchange rate remained steady throughout Q3.

With the decline in global prices of refined petroleum products and the appreciation of the cedi, pump prices of petrol and diesel are expected to slightly decline by about 2% and 1% respectively, while LPG is expected to rise by 1% in the second selling window of December 2023.

The post Market Outlook – 16th to 31st December 2023 Pricing Window appeared first on CBOD Ghana.